Since 2017, 1/3rd of every rocket launched globally was launched by SpaceX from their Falcon family of rockets. Around 70% of all current satellites orbiting the earth are Starlink satellites. SpaceX has landed major contracts through NASA for the Artemis program’s Human Landing System development and landing. The company has accomplished amazing feats like the first EVA (Extravehicular Activity) from a private company, AKA Spacewalk. They consistently provide transportation for NASA to the International Space Station when other suppliers did not meet the end of the bargain. SpaceX has unlocked pure dominance within the Spaceflight industry, and now we’re looking at who will be next to challenge them?

SpaceX has many different lines of business products such as their Vertical Launch System, Satellite Internet (Starlink), EVA Suit, Human Landing System, and Human Spaceflight businesses. To compete against SpaceX is compete against them in a specific category of their business rather than a whole encompassing ecosystem. We have categorized each main category of their business and the competitors on the rise you should look out for in 2026.

With each business challenger as well, we have rated them in how likely they are to compete with SpaceX. Each company is rated out of 20 being ranked out of 5 in Recent Progress, Funding, Business Viability, and Advancements in Technology. See our rubric at the bottom of this page for more information.

Vertical Launch Systems

The Falcon family of rockets has dominated the field since 2017 in launch of capability of satellites and other payloads. SpaceX is looking to continue their dominance into the future with their Starship launch system. Although there have been many challenges in the current development of the Starship test program. Recently, a Starship test article failed in Boca Chica, TX while undergoing cryogenic proof testing of the vehicle's structure. This test seemed to be routine for most previous Starship vehicles. Now SpaceX is being required to wait for the next Vehicle (Booster 19) to be completed and then they must test their new launch equipment before being ready for Flight 12. While the next test flight of Starship is being pushed out indefinitely, let's look at what challengers might take a jump against SpaceX in 2026.

Galactic Energy

Galactic Energy has quickly matured from a startup into one of China's most reliable private launch companies. Their Ceres-1 solid rocket has flown multiple successful missions, and the Pallas-1 reusable medium-lift rocket is progressing into testing. If Pallas-1 succeeds, Galactic Energy becomes a genuine low-cost competitor in the global market—not enough to dethrone SpaceX, but enough to pressure pricing.

Recent Progress: 4 – Consistent successful orbital launches; expanding rapidly.

Funding: 3 – Adequately funded but nowhere near Blue Origin or SpaceX.

Business Viability: 4 – China's domestic market + commercial customers give it room to grow.

Advancements in Technology: 3 – Solid-propellant and small liquid rockets; no breakthrough tech yet.

Score: 15/20

Blue Origin

Blue Origin is the only company with the financial firepower to match SpaceX. With New Glenn's recent flight success and historic landing Blue Origin has an opportunity to carve out space in the market.

Recent Progress: 3 – New Glenn delays continue, though hardware testing has accelerated.

Funding: 5 – Jeff Bezos continues to invest billions; runway is effectively unlimited.

Business Viability: 4 – Amazon Kuiper gives them a guaranteed internal customer.

Advancements in Technology: 3 – BE-4 engine breakthroughs, and orbital cadence starting to develop.

Score: 16/20

Rocket Lab

Rocket Lab is the most credible Western challenger in terms of execution discipline. With Electron they dominate the small-sat launch market, and Neutron, if successful, becomes the first true competitor to Falcon 9's reusability profile. They don't need to match Starship; they just need to capture the lucrative medium-lift segment.

Recent Progress: 5 – Neutron development accelerating ; Electron remains highly reliable.

Funding: 3 – Publicly traded , financially stable but not deep-pocketed.

Business Viability: 5 – Strong small/medium launch position, diversified revenue (Photon, components).

Advancements in Technology: 4 – Composite structures, advanced manufacturing, partial reusability.

Score: 17/20

United Launch Alliance

ULA is stable but not disruptive. Vulcan provides a reliable replacement for Atlas V, but without first-stage reuse, ULA cannot compete on price in the commercial market. ULA remains relevant to DoD missions but is not a long-term threat to SpaceX's global commercial dominance.

Recent Progress: 3 – Vulcan finally flying, but slowly.

Funding: 2 – Dependent on government contracts, minimal commercial ambition.

Business Viability: 3 – Niche markets (national security) keep them alive.

Advancements in Technology: 2 – No reusability; cost structure remains outdated.

Score: 10/20

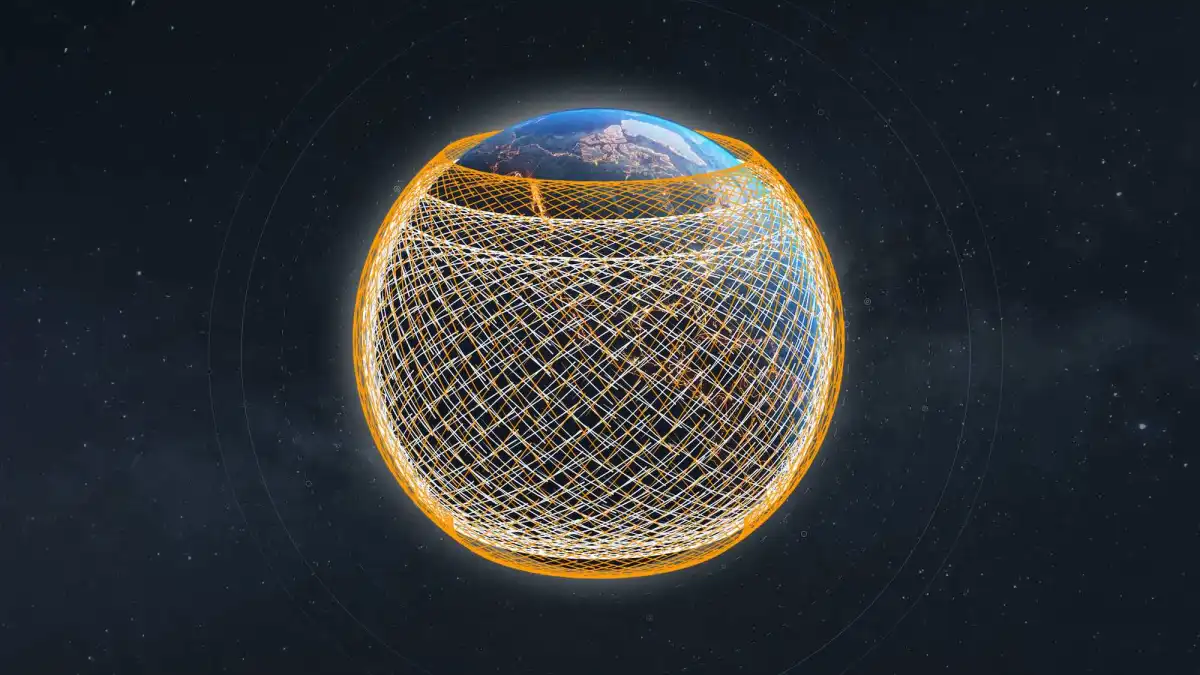

Satellite Internet

SpaceX has struck gold within their company Starlink by providing satellite internet services to customers. Payload Research reported an $8 Billion revenue from Starlink in 2024. Their services have expanded from private home internet to major plane companies, large naval vessels, and mobile devices. Specifically, with their partnership with T-Mobile they have a major opportunity to fund research & development within the rest of their company. You can find more analysis on a future Starlink IPO from my article.

Kuiper from Amazon

Kuiper is the only fully funded alternative to Starlink with the industrial capacity to scale. Amazon is aggressively building manufacturing facilities and ground networks. Their biggest bottleneck is launch capacity—New Glenn and Vulcan delays mean Amazon will spend much of 2026 trying to catch up to SpaceX's enormous lead.

Recent Progress: 4 – Prototype satellites performing well; deployment beginning.

Funding: 5 – Amazon resources allow massive capital burn.

Business Viability: 4 – Amazon ecosystem integration offers built-in demand.

Advancements in Technology: 3 – Solid designs but untested in large-scale operations.

Score: 15/20

OneWeb

OneWeb is no longer trying to compete head-on with Starlink; instead, it focuses on enterprise and government connectivity. Their technology is aging, and without a second-generation constellation in deployment, they are unlikely to challenge SpaceX directly.

Recent Progress: 3 – Constellation complete but limited.

Funding: 2 – Post-merger financial constraints.

Business Viability: 3 – Focus on enterprise/government niche.

Advancements in Technology: 2 – First-generation satellites outdated relative to Starlink V2.

Score: 10/20

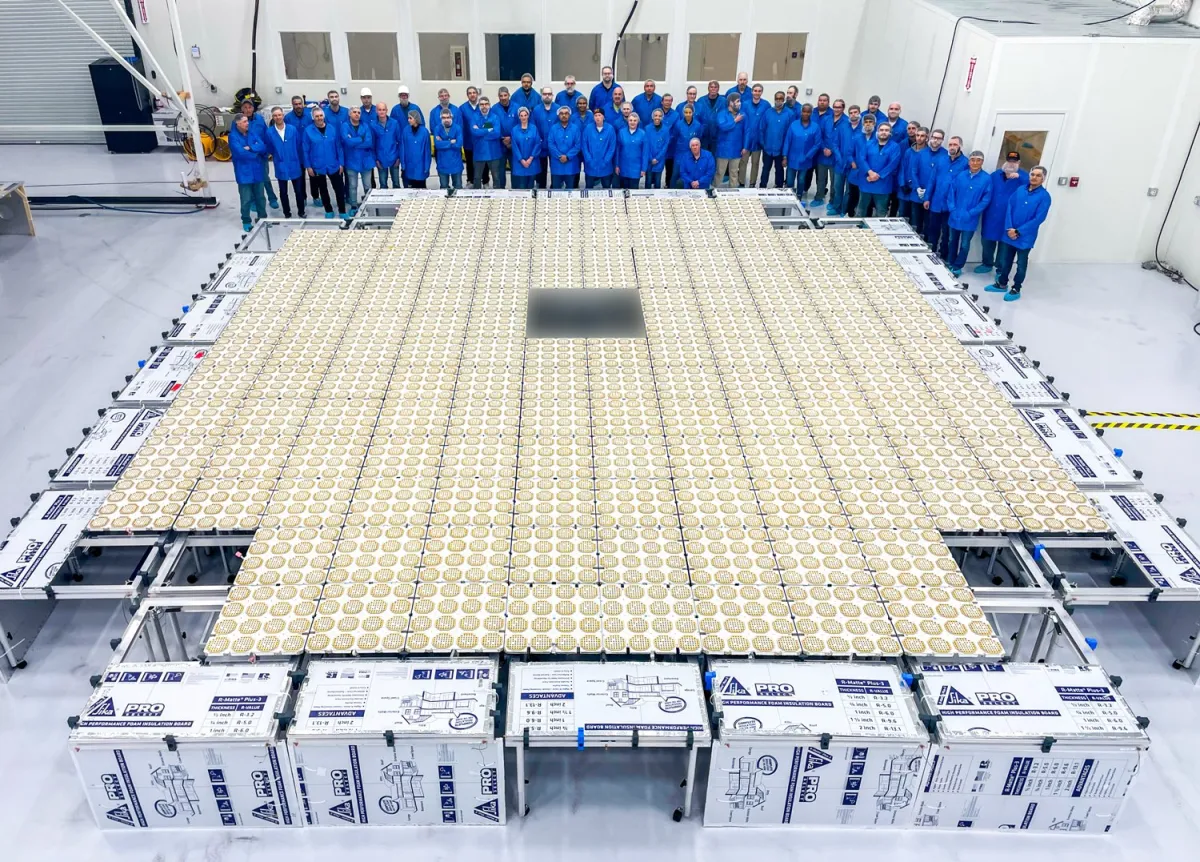

AST SpaceMobile

AST SpaceMobile's business model—direct-to-cell connectivity—positions it more as a technological pioneer than a Starlink challenger. With partners like AT&T and Vodafone, they have momentum , but scaling their enormous satellites into a constellation remains financially uncertain.

Recent Progress: 3 – Successful large antenna satellite tests; delays still common.

Funding: 2 – Cash-limited despite strategic partnerships.

Business Viability: 3 – Direct-to-cell is a promising but risky market.

Advancements in Technology: 4 – Novel large-aperture satellites.

Score: 12/20

EVA Suits

EVA Suits are pressurized vehicles that astronauts must use for any spaceflight outside of their normal habitat like the International Space Station. In 2024 SpaceX debuted their first EVA suit on the Polaris Dawn mission. It has been made clear by SpaceX Founder Elon Musk that these suits will be essential for the future of the company with the goal of colonizing Mars. Elon even offered to sell NASA spacesuits in 2021 while NASA was facing trouble in the development of their own in-house spacesuits for the Artemis program. This category is much different than the other competitors present, as SpaceX doesn't currently sell their suits to a customer. This will be essential in the future of the space industry, and a business case for the future of space exploration is extremely viable.

Collins Aerospace

Collins has been the backbone of U.S. space suit technology for years. Their updated EVA suit platform is reliable but evolutionary, not revolutionary. They remain a stable supplier but won't disrupt the industry.

Recent Progress: 3 – Continuing NASA xEMU development.

Funding: 4 – Large defense/aerospace contracts.

Business Viability: 4 – Primary NASA contractor for decades.

Advancements in Technology: 3 – Incremental improvements.

Score: 14/20

Axiom Space

Axiom is the most innovative player in EVA suits outside SpaceX. Their Artemis suit work and commercial station ambitions put them at the center of the future commercial space ecosystem. They could become a major EVA supplier through the 2030s.

Recent Progress: 4 – Artemis suit milestones achieved; commercial missions ongoing.

Funding: 4 – Strong investor backing + NASA partnership.

Business Viability: 5 – Positioning itself as the first commercial space station operator.

Advancements in Technology: 4 – Modern modular suit design.

Score: 17/20

Human Spaceflight

Since 2020, SpaceX has provided Human Spaceflight transportation services to NASA, other global space agencies, as well as other private customers looking to experience space for themselves. This has been a steady stream of revenue for SpaceX and has allowed them to advance their technologies towards specifically human spaceflight. There have not been many challengers in this space in the past few years, especially following the technical issues with Boeing’s Starliner capsule in 2024 . Just like EVA suits, this will be another area of focus for the future of the space industry and with technological developments, a competitor to SpaceX could emerge.

Blue Origin

New Shepard provides tourism but not true orbital transport. Blue Origin plans an orbital crew capsule, but progress remains slow. They are unlikely to challenge Crew Dragon before 2027–2028.

Recent Progress: 2 – No orbital crewed capability yet.

Funding: 5 – Massive backing.

Business Viability: 3 – Suborbital tourism strong, orbital unknown.

Advancements in Technology: 3 – Working toward reusable capsule design.

Score: 13/20

Boeing

Starliner's repeated technical issues have devastated confidence. Unless Boeing performs a complete program overhaul, they pose little competitive threat to SpaceX in crew transport.

Recent Progress: 1 – Major technical failures and grounding.

Funding: 3 – Backed by NASA contracts but losing internal support.

Business Viability: 2 – One commercial partner (NASA) and struggling.

Advancements in Technology: 2 – Capsule is functional but unreliable.

Score: 8/20

The Exploration Company

This European startup is moving quickly, developing the Nyx capsule designed for cargo and later crew. They are still years away from operational human spaceflight but represent Europe's most ambitious independent human-spaceflight effort.

Recent Progress: 4 – Rapid hardware development in Europe.

Funding: 3 – Strong EU investment but not near SpaceX scale.

Business Viability: 4 – Filling Europe's need for independent access to space.

Advancements in Technology: 3 – Modular capsule architecture.

Score: 14/20

Sierra Space/Dream Chaser

Dream Chaser is an exciting, unique system. The cargo variant will fly first, but a crew version is planned, and if successful, Sierra Space could open a new segment of runway-style reusable orbital vehicles, something no competitor (including SpaceX) offers today.

Recent Progress: 4 – Dream Chaser nearing first flight.

Funding: 3 – Private funding stable but not massive.

Business Viability: 4 – Cargo contracts + future crew version.

Advancements in Technology: 4 – Lifting-body reusable spacecraft.

Score: 15/20

Summary: Most Likely Challengers to SpaceX

SpaceX has established a level of dominance across the space industry that no company has matched in modern history. Their reusability, launch cadence, and fully integrated ecosystem place them years ahead of the competition. But as we look toward 2026, the landscape is beginning to shift. New players are maturing, legacy companies are reinventing themselves, and well-funded challengers are finally closing the technological and operational gap.

While no single company is poised to dethrone SpaceX outright, several are positioned to challenge them within specific business lines. Whether that’s launch, satellite internet, EVA technology, or human spaceflight. What we will see in 2026 is not a replacement for SpaceX, but rather the emergence of credible competitors that will force SpaceX to continue innovating at the pace that defined the last decade. This growing competitive pressure will shape the next era of space exploration and commercialization, and the industry will be stronger because of it.

The most likely competitors for SpaceX in the future will be Dreamchaser within Human Spaceflight, Axiom Space in EVA suits, Amazon on satellite internet, and Rocket Lab with their upcoming Neutron rocket system. For our rubric on how each company was graded towards competiting with SpaceX click here.